Rapid Mortgage Reduction

One of the frequently asked questions we get is "how can we pay off our loan faster?"

After all, the true cost of your mortgage loan is not just the interest you pay, it is also the amount of time it takes to pay the mortgage completely off.

We love helping people find those eureka moments that help them pay less on their mortgages. Not all people are able to pay more, but if paying more is possible for you, then this is how you can make that happen.

1. What is Rapid Mortgage Reduction?

First, let's be clear what rapid mortgage reduction actually is. Rapid mortgage reduction is a strategy that you can use to reduce the length of your mortgage and save a significant amount of money in interest payments.

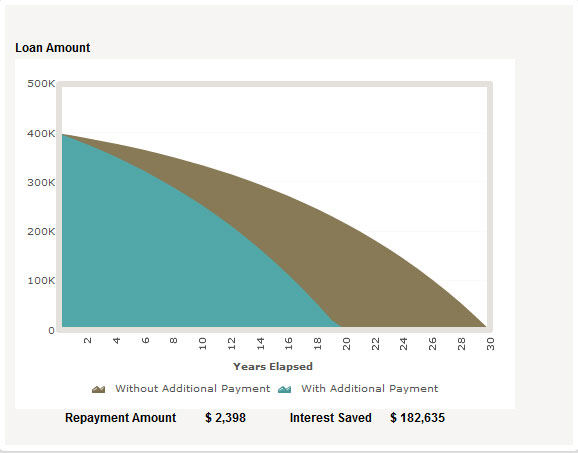

Below is an example of how you could save thousands of dollars and years of time on your mortgage.

This is based on a loan of $400,000, the interest savings are potentially $182,635.00 and the new loan term is only 20 years.

How can you use this strategy?

Some of the options that you could use to pay more on your mortgage include:

1. Making extra payments

Some banks and lending structures allow you make extra principal payments alongside your regular mortgage installments.

2. Paying fortnightly instead of monthly

By opting to make your mortgage payments fortnightly instead of monthly, you will effectively pay an extra month's installment annually.

3. Refinancing

Another option you could consider is refinancing your mortgage to a shorter loan term or a lower interest rate.

4. Debt consolidation

If you are struggling to make repayments on high interest loans or credit cards, you may be able to consolidate your debts into your mortgage so you pay one easy payment and less on the interest. This won't pay your mortgage off faster, but it will help you save money and take back control of your finances. Read more about this here.

By making additional payments towards the principal of your mortgage, you will reduce the outstanding balance faster, which will lower the total interest accrued over time and the length of time it will take to pay it all off.

We work with our clients to provide the best loan structure allowing total flexibility and control to reduce the mortgage more effectively. So if you're keen to find out how we can help, please do get in touch. Our advice is free.

Would you like to reduce the length of your mortgage?

Contact us to get free personal mortgage advice. Our brokers can guide you toward the right financial solutions for your needs, possibly saving you thousands and reducing the terms of your repayment.

Contact us >Latest News

Published by Scott Miller

Do Mortgage Brokers Charge Fees In NZ.

Introduction In the realm of mortgage brokers in New Zealand, it's important to note that while many brokers do charge for their services, there are exceptions.

)